Advantage executives can be described as investment advisors, pocket option site economic advisers, or riches executives. They often perform one’s otherwise organization’s investment collection, for the purpose of creating otherwise keeping riches. Resource managers always work to deliver investment efficiency that assist customers reach their monetary needs while you are looking to mitigate exposure. Although not, recently, resource administration businesses have created pooled asset structures such as common fund, list money, and change-exchanged financing (ETFs). Such formations are capable of place-it-and-forget-they buyers with less property (no less than versus riches these businesses normally handle).

Exactly what are the advantages of taking an online Investment Administration way?: pocket option site

These types of tasks are estimated to grow a lot faster than the overall employment market because of the challenges (and you will possibilities) away from navigating tremendously state-of-the-art funding landscaping. In general, even though, brokerage properties accept nearly one client, long lasting count they must dedicate, and these enterprises provides a legal standard to provide “suitable” services. Compatible essentially implies that should they make their greatest work to deal with the money intelligently, as well as in line using their clients’ said requirements, they may not be in control if their clients lose cash. Sell-top businesses including financing banks and stockbrokers, however, offer money features so you can AMCs or any other investors.

Soundcore Money Couples

However, worst administration methods is also harm your conclusion and you will potentially obstruct if not destroy progress potential. Asset management is actually a systematic process to cost-effortlessly procure, look after, modify, and you may discard organizational assets. The thought of spending time and cash protecting property that do not generate cash may seem like an ineffective entry to information. Although not, while the a corporate develops, the necessity for resource administration grows proportionally. The fresh ISO number of criteria, created by ISO TC 251, would be the international criteria for Advantage Management. ISO provides an intro and needs specification to have an administration program for investment administration.

It’s got offices inside Germany, Canada, Belgium, France, Italy, Ireland, British, Spain, and you may Switzerland while offering features so you can on the 40 million private investors. BlackRock also offers money and you can technology services in order to both merchandising and you will organization members global. Investment executives and anticipate the brand new lifespan and you may salvage worth of assets, and you may establish an excellent disposal approach in the event the assets reach the end of their of use existence. This is actually the last help controlling assets, the spot where the movie director often anticipate to the best of their capability the near future value of the fresh assets. After classifying the newest property, the newest manager will find the compatible advantage to be incorporated from the profile. This is actually the initial step inside the handling property, where the manager needs to choose just what property are available and you may what must be done with them.

What exactly is Asset Administration?

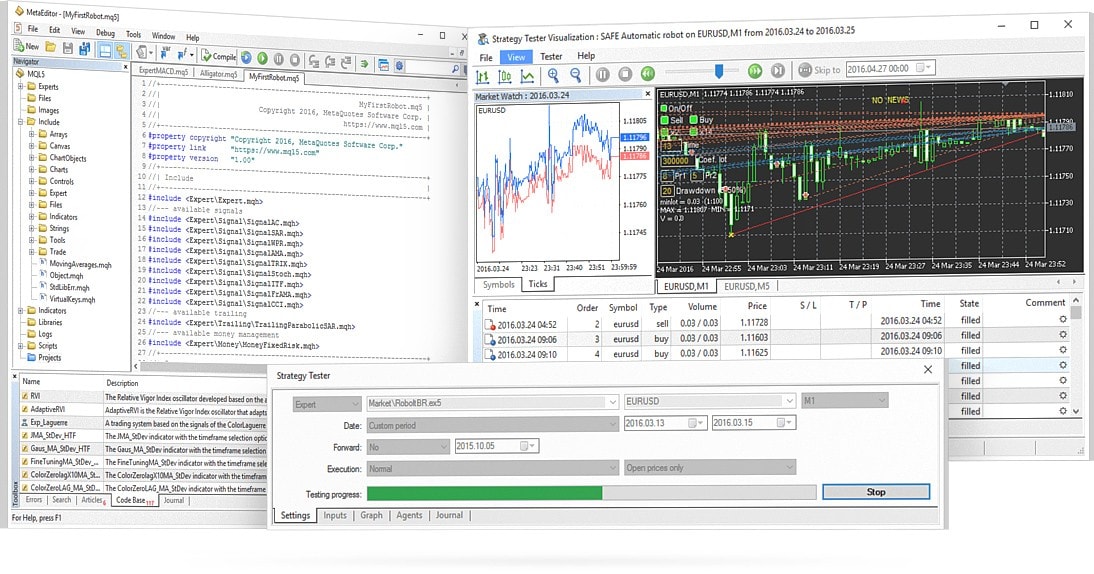

Simultaneously, certain official AMCs such hedge money may charge efficiency fees for promoting efficiency over a-flat height or you to defeat a benchmark. A asset administration process support organizations screen and manage their possessions using a systematized means. That have a powerful procedure, organizations can be raise production and you can performance from an asset for this reason improving the brand new get back to the update. DAM software brings a cost-active means for managing entry to digital property. The goal of a good DAM method is to include framework in order to the brand new workflow and you will lifecycle away from a business’s digital possessions, along with videos, pictures, sound files, design data files, and you can presentations.

This is done from the looking at economic comments or other associated suggestions. To possess businesses, this could include utilizing independent court structures such partnerships, organizations, otherwise trusts, tailored for the character of your own assets owned and also the potential loan providers. Financial believed is a meticulous procedure of evaluating certain financial options available to anyone and you will selecting the best suited procedures. Profile administration requires choosing the compatible blend of investment as kept within the a collection and you will determining the fresh allowance of these opportunities.

Why you Is Faith Fund Strategists

The fresh elite group should be able to explain investment actions and you may choices obviously and be happy to respond to questions you’ve got. Its systems plus-depth business knowledge can help unlock the full prospective of an investor’s wide range. That it proper resource allotment are an energetic process that requires to your said the newest switching monetary landscape plus the customer’s evolving requires and desires. It will make an incentive to your movie director to expand the new profile, as his or her money myself means the size of the newest assets it manage. Ahead of engaging a secured item director, you should be sure its back ground and you can reputation.

Common Money Executives

It’s a major in public areas replaced company which have an industry capitalization of approximately $114.99 billion at the time of January 30, 2024. BlackRock recorded a secured item below government (AUM) out of $9.ten trillion at the time of Oct 13, 2023. Starting sturdy solutions for tracking such property is crucial to stop losings out of thieves, wreck, or obsolescence.

Thus, it’s been put since the a brand administration tool to make certain one internal groups follow brand name direction and keep maintaining brand name structure. They resource management (ITAM) is actually a set of company processes for partnering They assets across the business. They brings together monetary, list, contractual, and you may chance management responsibilities to manage the entire lifecycle from it property such software and you may tools. Investment administration companies (AMC) dedicate pooled finance away from members and place the administrative centre to work as a result of various investments, along with ties, brings, a house, and you may master minimal partnerships.

He has the new options to understand suitable funding options round the an excellent quantity of possessions, which is hard for individual traders to complete to their own. Asset executives may help buyers broaden their profiles around the individuals advantage classes, sectors, and places, thereby distribute exposure. Advantage managers gamble a crucial role in the pinpointing hazards and you may using methods to mitigate him or her. This may encompass looking at market fashion, evaluating geopolitical incidents, otherwise offered economic indications. It resource administration not only makes it easier to trace, look after, and you can package according to possessions’ expected life, as well as brings investigation protection, instant discussing, defense against unauthorized access, worms, and more. These resource management comes to securing the new resources and you will application belonging to the company and you will which makes it easier to trace, organize, and you may express.

Before hiring an asset movie director, an investor would be to feel safe requesting a duplicate of its payment structure. The companies must pick and you can familiarize yourself with various investment groups that define the organization. While you are professionals is going to do that it to the a worldwide and you will aggregate peak, using certified software program is the most effective way in order that the newest investment management processes is done effortlessly. Investment executives utilize researchers and you may experts responsible for record asset overall performance, getting sound funding guidance, and looking after almost every other employment that may affect the assets’ results.

They believe many points, and worldwide economic climates, industry trend, and you will governmental advancements, to expect prospective dangers and you may manage the newest portfolio. An asset manager undertakes multiple obligations designed to your reaching the most productive and you will productive usage of resources. An asset Movie director is actually a specialist who meticulously oversees, manages and coordinates the fresh assets of people otherwise a corporate entity. Clients should consider the newest manager’s results over other industry cycles and you will up against related benchmarks. This allows traders to target other areas of the existence, with the knowledge that their investments are now being skillfully addressed.

By giving an intensive collection out of services, as well as collection construction, chance mitigation, funding allotment, and you may portfolio rebalancing, they skillfully point economic possessions to optimize output and you may manage riches. Resource executives aren’t explore commission structures such as a percentage out of assets below management, performance-dependent charge, repaired costs, or a mixture of these types of. The benefits of entertaining a secured asset director is its certified systems, options to possess portfolio variation, use of personal funding product sales, and also the convenience of time and fret reduction. Despite the enhanced chance, effective hedge finance managers is also send unbelievable output, making it a financially rewarding area of advantage administration for those that have a premier-chance tolerance.

ست ها

ست ها