Content

eleven Monetary may only transact team when it comes to those says in which it’s entered, otherwise qualifies to own an exemption or exception out of membership conditions. 11 Economic’s site is bound to the dissemination from standard information relevant so you can its advisory functions, as well as use of a lot more investment-associated information, books, and you may backlinks. Fund Strategists have a marketing reference to a number of the enterprises incorporated on this web site. We may earn a commission once you just click a link otherwise buy something from the hyperlinks for the all of our webpages. All of our articles is dependant on mission investigation, and the feedback are our very own.

Which money technique is titled “passive” because it means restricted effort and time. Currency chance can also add an extra coating out of variation so you can a healthy collection, which’s perhaps not an inherently bad issue. But when you real time and you may are employed in Canada, and when you want so you can retire here, you probably don’t require all possessions denominated inside the foreign exchange. A healthy portfolio detailed with, state, 40percent ties and you can 20percent Canadian brings has only 40percent met with foreign currency. Compare which to the Lime Collateral Growth ETF Profile, where the number is about 97percent.

Otherwise, for those who’re happy to spend more to own benefits, roboadvisors tend to create and maintain an ETF collection for your requirements to own lower than you’ll pay for the new Tangerine finance. Are you aware that idea that the brand new broadening rise in popularity of indexing try an excellent “bubble”—a term regular inside the a recently available Economic Blog post blog post—it’s so ridiculous it’s difficult to know where to start tricky they. A bubble is really what occurs when a valuable asset’s price is inspired right up well beyond exactly what appears to be the inherent value, such a good tulip bulb offering to own ten moments the typical worker’s paycheck. Whenever i dispute on the podcast, indexing continues to grow because the customers move away from expensive and you will disappointing lending products towards less of these you to deliver on the easy hope. In the 2012, The world and Post asked Andrew to participate an ongoing enterprise called Approach Laboratory. It follows five traders with various procedures and you will music the portfolios’ performance.

Better 100 dividend stocks within the Canada 2025

I’ve recommended index paying and also have tracked the couch Potato Portfolio within this line for over 13 many years. Very first, directory using will do better than on the 70 percent of treated profiles. If you possibly could divide by the a few with the help of a good calculator, you’ll be a couch potato collection director. There are tons away from concepts available to choose from, such as somebody shifting to secure bets or pouring currency to the U.S. stock-exchange which have AI and Nvidia best the brand new costs.

Couch Carrots Discount FAQ

Yearly, the guy said, you should rebalance the brand new profile so it’s again fiftypercent brings and you will fiftypercent ties. Understand the chart less than based on how an excellent 60/40 You.S. balanced portfolio appears facing a balanced portfolio having 20percent bonds and you may 20percent silver. The fresh products allocation is not on Portfolio Visualizer away from 1972, and so i made use of silver since the rising prices-fighter. Silver is even known as an excellent “secure sanctuary asset,” as it typically functions better when inventory areas proper inside the competitive style.

The couch Potato collection fell 15.33 percent in the dotcom crash. In any event, for those who measure achievements by the perhaps not not having enough money, Inactive paying wants very good. One become your retirement that have those three straight years of refuse. At the conclusion of 20 years their nest-egg is only a little larger than everything been which have. Really the only tranquility are depraved – at the many years 85 truth be told there’s simply a good 19 percent chance couple remain live. In reality, for many who retired three decades before, you’ve left up with rising prices.

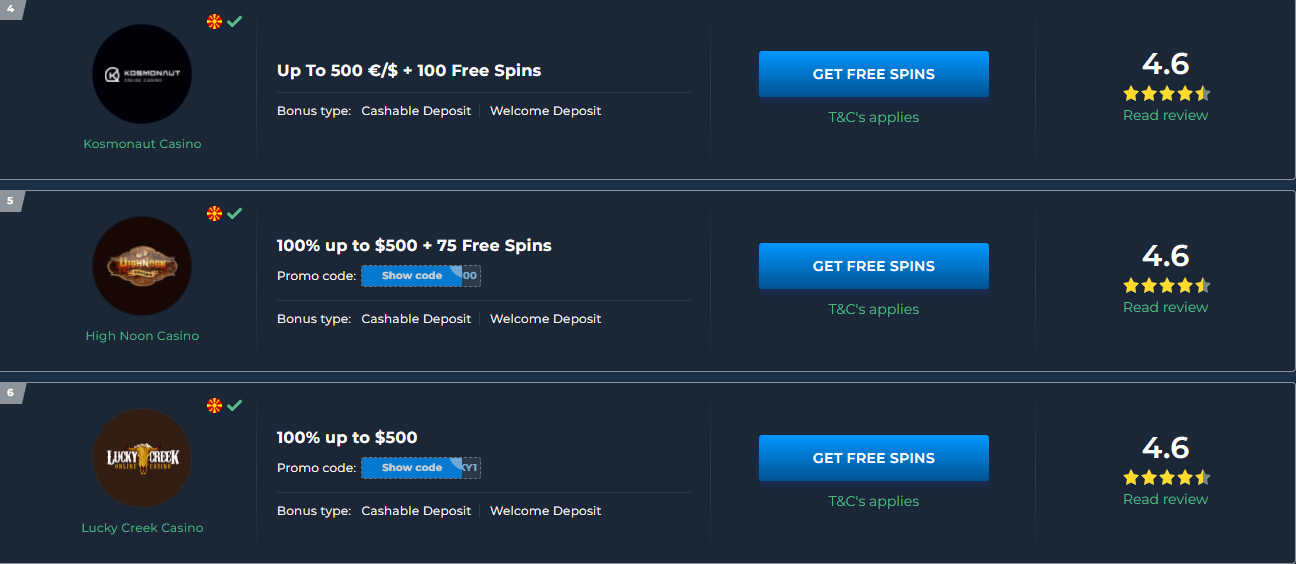

Just in case you get generate their particular inactive ETF portfolio, read the MoneySense ETF Finder Unit plus the greatest ETFs in https://happy-gambler.com/770red-casino/ the Canada. “The fresh stagflationary surprise from 2022 is truly international, having diverging progress and you may rising prices criterion round the really nations with lots of different factors exacerbating the brand new trend in the a good synchronized method. Investment assets has yet observe constant rising prices otherwise stagflation prices, even if resource results inside the 2021 and that is hinting in the the way they you are going to work inside a long inflationary environment. So, keep in mind, there hasn’t started a real try away from rising cost of living property. Stagflation—when rising cost of living is actually highest and you will growth try reducing—lasts for ten years. Only look at the stagflation of your seventies because seeped on the eighties (on you to afterwards).

All-climate ETF profiles

A robust loonie can get a poor affect the performance, while you are a failing Canadian money can give the newest collection a boost. The majority of people in addition to be TWRRs is actually unimportant to help you private traders, as the timing of cash circulates may have a large impact about how precisely we understand overall performance. Justin now offers a dramatic exemplory case of just how an investor whom generated a big share just before the newest overall economy of 2008–09 have got a great TWRR over cuatropercent even if his profile in reality missing really worth. To possess old-fashioned people particularly, another option would be to blend the fresh Leading edge The-Equity ETF Collection (VEQT) and you can a thread ETF having a ladder of GICs. For example, if the target resource allowance is actually sixtypercent fixed-income, you might hold forty-fivepercent inside the GICs for the almost every other 15percent within the a thread ETF. Even although you be able to start with a great collection and a strong funding package, will ultimately you are lured to dump they.

Rather than diving on the equities, get the foot moist which have a well-balanced collection to see what type of… The new quick answer is yes—but simply as you you would like cashflow from the profile doesn’t indicate you need to stock up to the dividend-investing brings. Moving your existing profile will involve particular records and you can fees, also it will need a couple of weeks, sometimes lengthened. Your brand-new broker tends to make sure you complete the right models, and so they will get reimburse the fresh import costs for many who’re swinging an enormous contribution. Met with the Up-to-date Passive portfolio become 2/3rd Overall Stock market and simply 1 / 3rd Cutting edge Rising cost of living Safe Ties, the new output might have been quite similar. During the its bad the newest Margarita Profile forgotten 16.5 percent away from new value.

Passive Profile Opinion and you can ETFs (Scott Burns,

The fresh government debts proportion (MER) fees during these profiles range between 0.72percent to one.06percent, according to what type you decide on. Inactive investing, for example passive paying, relates to minimal lookup and you can study and you may aims to imitate the new results of a standard directory. Effective investing comes to buying and selling individual ties otherwise common money in an attempt to outperform the market industry. When you are active spending could easily trigger large output, inactive using normally outperforms over the long lasting because of all the way down costs and you will costs.

The results often gradually taper away from following the peak, and you might consistently feel the effects for several far more occasions. Generally, the majority of people realize that the results of delta-9 gummies begin subsiding during the cuatro hr mark. Perhaps you’re also wondering for many who’ll getting “high” from all of these gummies. THC (tetrahydrocannabinol) ‘s the psychoactive substance inside marijuana guilty of the newest euphoric and you can mind-changing effects. Whenever drinking THC gummies, the brand new THC communicates having receptors on the head, ultimately causing altered impact, recreational, and other psychotropic effects.

For individuals who comprehend something that you be is actually completely wrong or mistaken, excite e mail us. MoneySense is not responsible for content for the additional internet sites that people can get relationship to inside the articles. I aim to getting clear when we discovered settlement to own advertisements and you can links on the our very own website . Paid back blogs that is sponsored, displayed or produced by a great MoneySense mate is actually branded. The entrepreneurs/lovers also are maybe not guilty of the precision of the information on the the webpages. Be sure to review tool guidance and vendor words and requirements on their sites.

Burns off himself provides used a number of suggestions away from particular property typically, the while keeping it fairly standard and still allowing you to Doing it yourself they. Within the detailing the initial iteration out of Passive Collection, Burns recommended an enthusiastic S&P five hundred list finance and you may an initial-term regulators thread fund. Punctual toward 2018, in which he states complete stock market money and you may full bond industry money. Inactive paying try a couch potato financing strategy that requires paying inside a great varied collection of low-cost index money or ETFs and you may holding them to the enough time term.

To learn more about performing more taxation-successful ETF Couch potato collection, check out this post. Both provides minimal opportunities away from step 3,one hundred thousand and allow additional assets of simply 100. Which means beginning with six,100 and you will include as little as 100 at the same time up coming. Such five effortless Key Profile techniques make you a number of options in order to start off. An economic elite group can give advice based on the suggestions considering and supply a no-duty call to better understand your situation. Inactive spending is even more foreseeable than simply effective using, as it aims to song the brand new efficiency away from a benchmark index unlike looking to surpass it.

ست ها

ست ها