Addition to restore-Replaced Finance ETFs

The fresh distinction to be the first exchange-exchanged money is frequently made available to the brand new SPDR S&P 500 ETF (SPY) revealed because of the County Road Worldwide Advisers on the Jan. 22, 1993. There have been, yet not, certain precursors in order to SPY, as well as Directory Contribution Equipment listed on the Toronto Stock exchange (TSX), and that monitored the newest Toronto thirty-five List and you may appeared in 1990. There are 10 ETFs focused on companies engaged in silver exploration, leaving out inverse and leveraged ETFs and people which have apparently reduced assets below management (AUM). AMBCrypto’s blogs is meant to be informational in general and ought to not be interpreted while the investment suggestions. Trade, selling cryptocurrencies is highly recommended a leading-chance money and every reader is advised to complete their particular lookup before you make one choices. We offer advice which have ETF evaluations, profile steps, portfolio simulations and you may money guides.

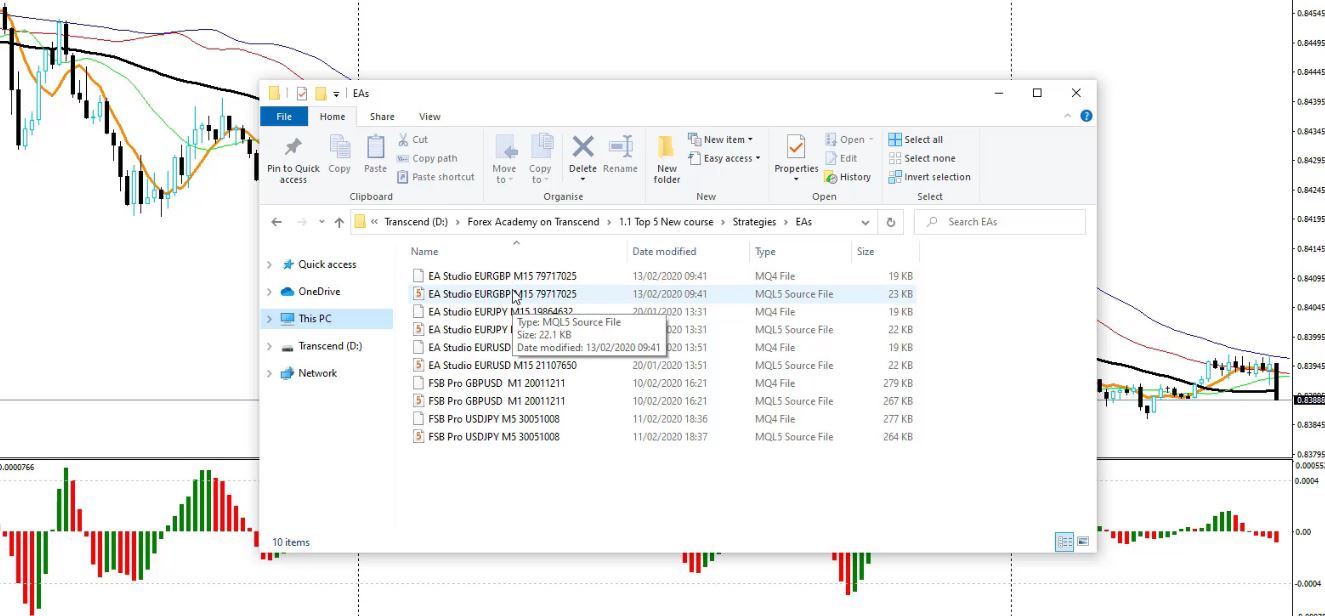

Creation and you may construction out of ETFs: Discover Olymp Trade tools

ETFs is actually appealing, particularly to pupil investors, since they will let you very own a varied profile having a great solitary financing equipment. Extremely ETFs are designed to tune a particular industry otherwise list, like the S&P 500 or TSX Compound Index. Thematic ETFs are comprised from a portfolio out of carries you to depict a specific motif or trend. He’s designed to song a particular investment theme, such as intercourse range or advancement otherwise robotics and you may cybersecurity. Including, an excellent thematic ETF concerned about sex diversity may only spend money on organizations in which at least 25% from board players are ladies.

Dividends on the ETFs

They often pursue earliest patterns such index ETFs, bonus ETFs otherwise low volatility ETFs and you will behave like a passive directory ETF, albeit having yearly, semi-yearly, or quarterly rebalancing. They have straight down MERs than simply an earnestly addressed ETF however, large MERs than just traditional ETFs. Just like any funding, it’s crucial to stay informed, understand the risks, and you will constantly reassess their method within the white of one’s money objectives and you can changing business standards. With mindful thought and you will wise choice-and make, ETFs will likely be a very important component of your investment collection. Tactical resource allowance concerns occasionally changing the new mixture of assets within the your profile according to business requirements and you will financial forecasts.

ETFs might be super-wider in the focus, attempting to tune a standard industry index including the S&P 500, or the results of a whole country’s discount. They could additionally be ultra-thin inside desire, specializing for the a little set of organizations in one single subsector. After goal setting and you may evaluating ETFs, go deeper more resources for Discover Olymp Trade tools exactly how for every ETF compares to the secret metrics, in addition to performance, exposure, costs, and you will center holdings. And also next, the first excitement can easily consider concern if the stock you decide on doesn’t work well. Just before investing people ETF, always comment its prospectus and you will relevant documents to gain a standard knowledge of their wants, dangers, charges, or other services. This type of focus on technology, health care, time, and other elements of the fresh cost savings.

This post is available with Federal Bank Head Broker (NBDB) to have suggestions aim merely. It makes zero legal otherwise contractual duty to possess NBDB and also the information on this particular service providing plus the requirements here is subject to improve. The message associated with the Website exists to have standard advice aim and cannot become interpreted, thought otherwise made use of because if they were financial, court, financial, and other advice at all. Simultaneously, the information presented on this site, if or not financial, financial otherwise regulatory, may not be legitimate outside of the state from Quebec. Some other element worth considering is the full part of holdings you to the major ten holdings represent.

The outcome out of having either one are effectively a similar in the the long run. It means their portfolios just seek to imitate the fresh holdings and exposure functions from a particular directory since the directly you could. It indicates carrying an identical bonds because the benchmark inside the comparable dimensions.

- Very brokerages have a tendency to charge a fee payment (usually $ten or shorter) once you pick otherwise promote a keen ETF.

- Stock segments try unpredictable and will change notably in response so you can organization, globe, political, regulating, market, or financial improvements.

- Directory finance try more well-known, making-up more than 4/5s of your own assets lower than government in the U.S.

- Tactical investment allocation relates to occasionally adjusting the newest combination of property in the their portfolio considering industry criteria and you may financial predicts.

- ETFs is noted on public transfers, and buy and sell her or him throughout the field occasions simply for example brings.

What the information way for your money, along with suggestions to help you spend, save, and you may invest. Stay linked to iShares and you may speak about extra tips made to help your realize your financial desires. If you’lso are looking to generate money, or to merely save up to own a holiday, iShares ETFs tends to make using as simple as opting for a great playlist of tunes. And’lso are transparent — Letting you see just what you possess and keep the resource allocation down.

The brand new examine unit reduces all the details for the 4 parts found hand and hand, the first being the review and that apart from getting a bona fide time quote as well as suggests the brand new benchmark, online property of your own ETF and the management payment. Country-certain ETFs work with a certain nation or urban area including Canada otherwise European countries. In the last two decades, ETFs has switched how professionals and people availability funding opportunities, because of the independence and you may availability.

Couch potato ETFs normally standard and simulate the brand new path out of a catalog for instance the TSX, the fresh S&P five-hundred, otherwise movement inside the a particular market for example gas and oil otherwise biotech. To begin with very ETFs were couch potato and never definitely handled – on the goal of recreating as the faithfully that you can the root directory from the most reasonably priced. Replace traded fund (ETFs) have been 1st created in the newest 1990s in an effort to offer private traders entry to couch potato, listed financing.

The new HSBC FTSE UCITS ETF try listed on the London Stock Exchange and you will investments within the ticker symbol HUKX. The fresh ETF features a continuous costs of 0.07% and you may a dividend yield away from step three.56% as of April 2025. Earlier reports brought winners including App (+97.3%) and POWL (+61.8%) in just thirty days.

What is the Difference in a keen ETF and a mutual Finance?

The level of redemption and you may creation pastime are a function of demand in the business and you will if the ETF are trading during the a savings otherwise premium for the property value the new financing’s property. IShares aren’t offers away from a buddies, he’s systems from a fund and this retains a collection tailored to closely tune the newest results out of a selected field list. IShares ETFs trade on your own local stock-exchange in the same method since the offers of any social business. Fidelity is not recommending or promoting which investment by creating it accessible to its people. Prior to people funding choices, you should check with your individual elite group advisers or take to the account all sort of points and points of the individual situation.

What’s An enthusiastic ETF (EXCHANGE-Replaced Finance)?

In the eventuality of personal bankruptcy, an excellent organization’s loan providers bring precedence over the stockholders. Fool around with our screener to understand ETFs and you can ETPs one suit your money requirements. Since the ETFs are premade finance, you don’t get a suppose with what they spend money on. So if you choose to spend money on certain fund, make sure that you’re comfortable and you can invested in wearing exposure to all those people bonds. These types of add the brand new 100 premier in public areas noted enterprises on the nation.

The first step to make use of the brand new contrast unit is to provides a listing of ETFs, We went in the future and you will used the ETF screener to incorporate a good set of effective & passive Canadian equity ETFs. Here’s all you have to know about ETFs and just why thus of a lot traders are drawn to him or her. Variation and asset allowance do not make sure an income otherwise make sure facing losses. However, you will be able to have an ETF to combine elements of couch potato and you can productive, such if the a finance comes after a custom directory. ETFs can be somewhat complicated when you search deep to the all the information, however for what the mediocre buyer knowledge, they’re usually obvious and you can exchange. Costs could be affected by some financial, financial, societal and you may political things, which may be volatile that will provides a life threatening effect on the values out of products.

ETFs try pooled financing automobile that offer investors the chance to go varied exposure to a broad directory of possessions, such brings or securities. Unlike old-fashioned shared financing, yet not, ETFs is actually exchanged to the major stock transfers, which means ETF offers are available to be bought and offered when the marketplace is discover. Rather, a broker typically encourages buy and sell orders between people and you will the new mutual finance business, or you might interact personally to your common finance company.